Common Credit Report Errors

Incorrect Personal Information

What to Look For: Mistakes in your name, Social Security number, address, or birthdate. Even a minor spelling error in your name could result in another person's credit activity being reported under your profile.

Impact: Incorrect personal information can lead to mix-ups with other accounts and possible identity confusion.

Account Ownership Errors

What to Look For: Accounts listed that you don't recognize, accounts marked as open when they're closed, or debts that belong to someone else.

Impact: Accounts mistakenly added to your report could raise your debt-to-credit ratio, hurt your credit score, and indicate possible identity theft.

Duplicate Accounts

What to Look For: The same account appearing multiple times, which might happen due to reporting errors or when a debt has been transferred to a collection agency.

Impact: Duplicate accounts can increase the appearance of your debt load and negatively impact your credit utilization rate.

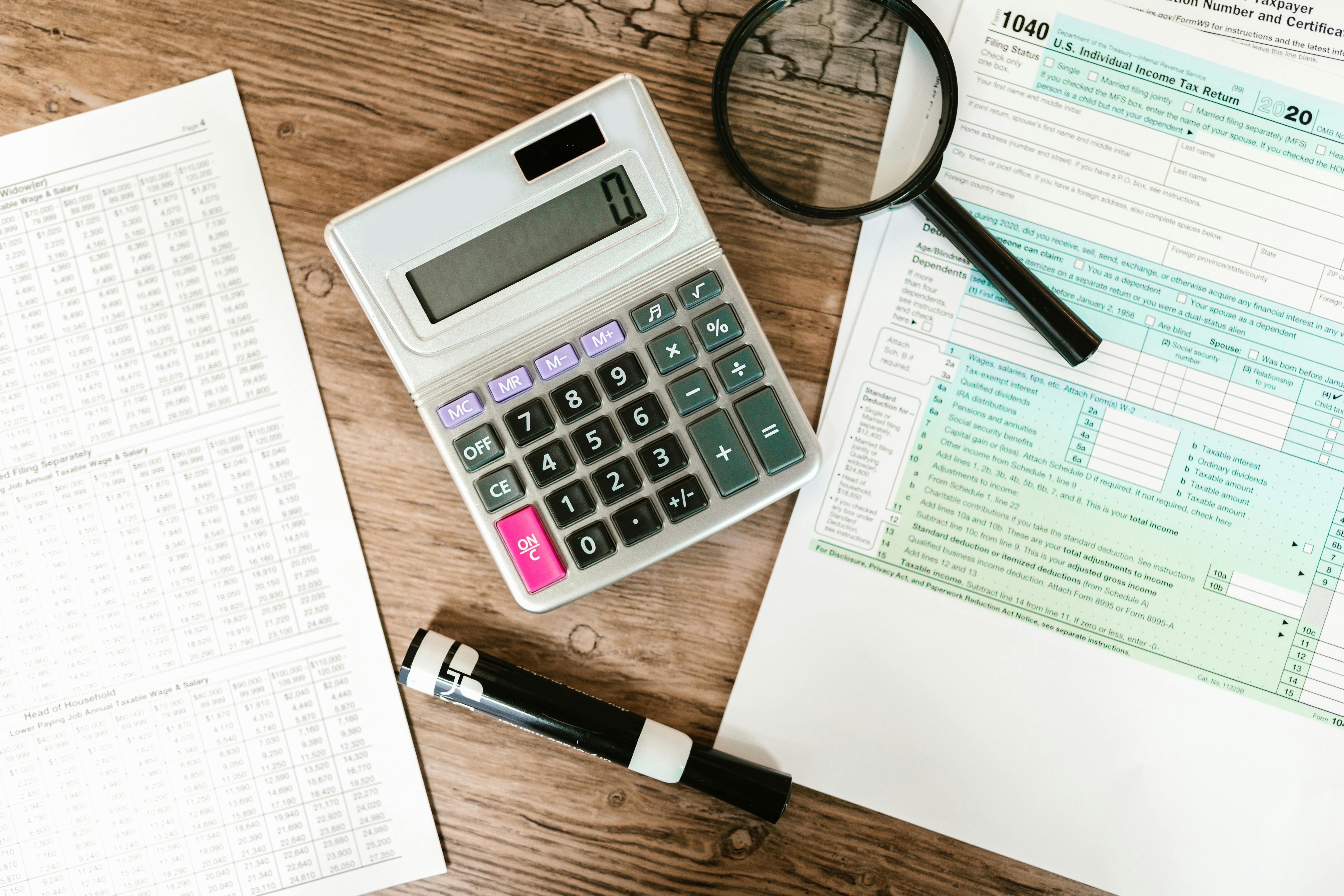

Incorrect Account Status

What to Look For: Accounts incorrectly marked as late, charged-off, or in collections, or accounts not showing as "paid� even after settling.

Impact: Incorrect status, especially late or delinquent designations, can severely lower your score, as payment history is a major factor in credit scoring.

Incorrect Balances or Credit Limits

What to Look For: Balances that don't match what you actually owe or credit limits that are inaccurately reported.

Impact: This can affect your credit utilization ratio, which is a crucial factor in determining your credit score. High utilization percentages, especially if incorrect, can lead to score drops.

Outdated Information

What to Look For: Accounts that should have been removed due to time limits (e.g., old collections that should no longer appear after seven years).

Impact: Outdated information, especially if negative, can harm your credit score and make you look riskier to lenders.